401k max contribution 2021 calculator

There are two sides to your contribution. A Roth IRA conversion is a way to move money from a traditional SEP or SIMPLE IRA or a defined-contribution plan like a 401k into a Roth IRA.

Free 401k Calculator For Excel Calculate Your 401k Savings

Additional contribution limits may apply to Highly Compensated Employees.

. 7200 8200 if age 55 or older The contribution deadline is April 15 2022 the federal income tax deadline. Keep this deadline in mind if you need a last-minute tax deduction and have the extra cash. Start with a healthy amount each month.

Your plan may permit special 457b catch-up contributions for additional savings during the three years before your normal retirement age as stated in the plan. This might be 20 200 or 1000 a month. Apr 28 2022.

This is a great way to maximize your tax advantages for those looking to quickly bulk up their retirement accounts. Theres no limit to how much money you can put in an annuity. 8 Sticking with our example above maxing out your Roth IRA and investing 6000 into your account brings your total retirement savings for the year to 9750.

This means that if you are 50 or over you can contribute a total of 27000 per year into your 401k. If you select today it may work. Below is the key rules of thumb.

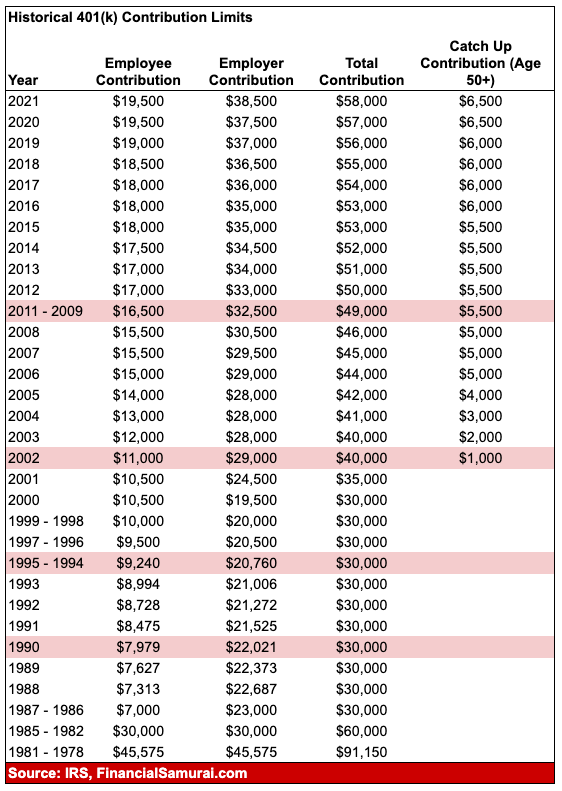

Make sure youre maxing out your 401k Roth IRA HSA Accounts and all other investment accounts that will help long term. Contribution limits. Individuals over the age of 50 can contribute an additional 6500 in catch-up contributions.

Hi Ali you have to contribute the same percentage of W2 to the eligible employees including yourself. Fri Aug 12 2022 428 am Long time lurker I started maxing my 401k terrible match in the last 4 years but still feel behind for my age. For Solo 401k the contributions have to come from your sponsoring business.

What you provide as the employee and the match from your employer if applicable. I went through BuyDirect and chose 12302021 it on the final page before I would click submit said. Yet most people dont know how to max out a 401k.

For 2022 the 401k contribution limit is 20500 in salary deferrals. If you want to get a larger contribution for 2020 you can only do a cash balance plan or defined benefit plan. For instance in 2022 the 401k contribution limits rose 1000 from 2021 You start full-time employment at age 22 at a company that provides a 401k without a company match.

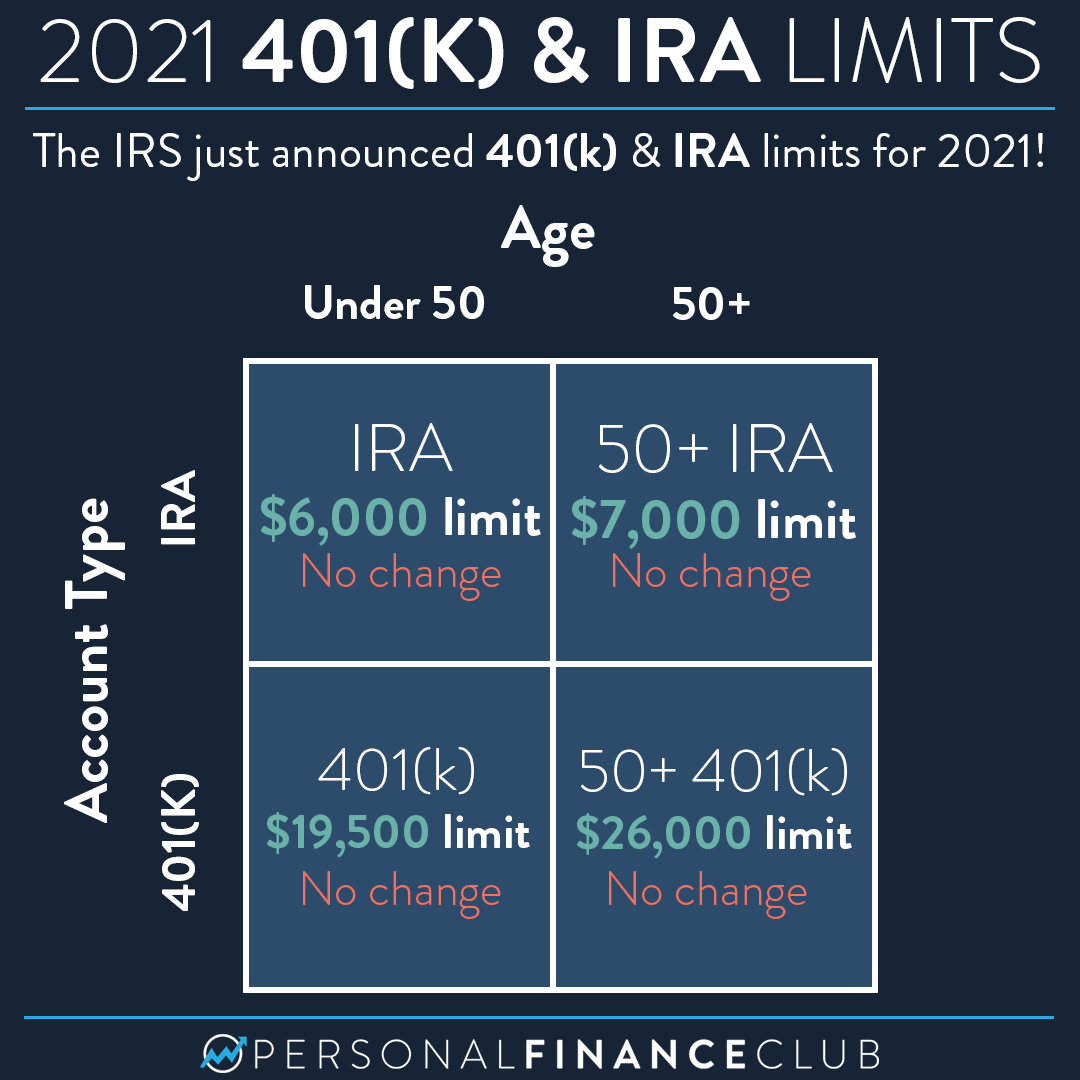

An individual with coverage under a qualifying high-deductible health plan deductible not less than 1400 can contribute up to 3650 up 50 from 2021 for the year to their HSA. For 2021 and 2022 6000 per year 7000 per year for those age 50 or older. If you have 20 years until retirement and you expect average annual growth of 7 the calculator suggests a monthly contribution of 610.

3600 4600 if age 55 or older Families. Contributing the max to both accounts results in a total tax deferral of 41000 per year not including catch-up contributions. You can see more details in our in-depth analysis and comparison between IUL and 401K to see which is better for your personal retirement savings plan.

The 401k plan annual contribution limit is 20500 while the catch up contribution is 6500. To contribute to a Roth IRA in 2022 single tax filers must have a modified adjusted gross income MAGI of 144000 or less up from. 19500 in 2020 and 2021 19000 in 2019 18500 in 2018 and 18000 in 2015 - 2017 or 100 of the employees compensation whichever is less.

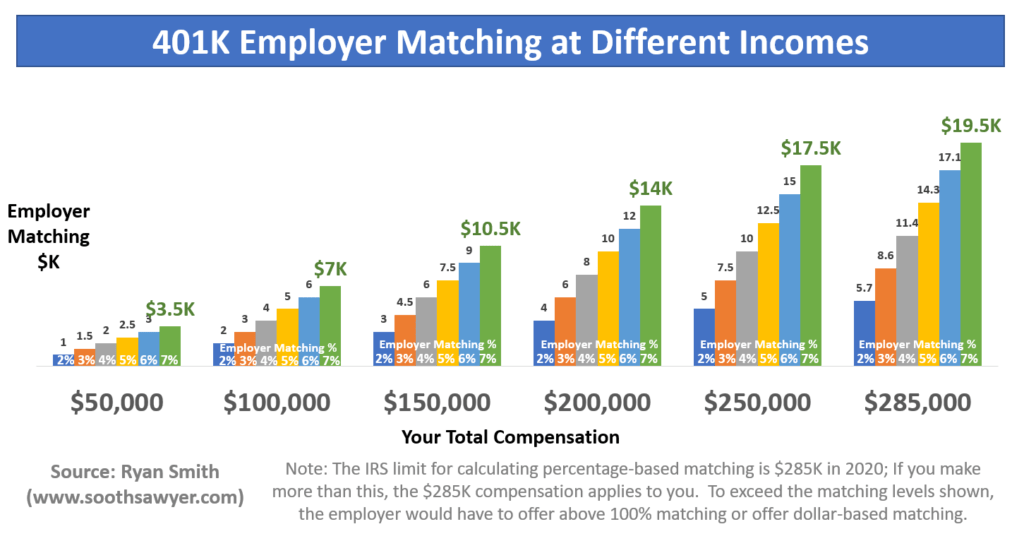

Your total contribution including employer-matching funds cannot exceed 61000or 67500 for workers 50-plus. Especially matched benefits programs like 401k before putting in money. A contribution is the amount an employer and employees including self-employed individuals pay into a retirement plan.

Many employers offer a match based on a percentage of your gross income. For 2021 the max contribution is 58000 and 64500 if you are 50 years old or older. For 2022 20500 per year 27000 per year for those 50 or older.

Get your 401k match then max out your IRA. The maximum out-of-pocket has been capped at 7050. In 2022 the individual limit is 20500 or.

According to a Vanguard study only 12 of plan participants managed to max out their 401k in 2019. The more you put into your account the more youll get each. 2022 HSA contribution limits.

Find your total contribution. They cant come from your W2 job pensions rental income or other sources not considered to be self employment income. Dayana Yochim Andrea Coombes.

2021 HSA Contribution Limits. You can only contribute a certain amount to your 401k each year. Just a little bit short of your retirement savings goal.

You can correct the contribution and deposit the correct amount and take the tax deduction. In 2021 you can put up to 6000 into a Roth IRA and an extra 1000 catch-up contribution if youre age 50 or older. Backward since the average 401k contribution limits were lower in the past.

How to Max Out a 401k. The elective deferral limit for SIMPLE plans is 100 of compensation or. Yes you can max out both your 401k and 457 plan up to the maximum allowed by the IRS which is 20500 for each account.

You could consider a 401k for 2021. Meanwhile there are 401k annual contribution limits. My income increased significantly in the last 5 years at my company so Ive started to max my 401k and luckily they now offer an HSA which Ive maxed as well when it became available.

2022 HSA Contribution Limits. The combined contribution limit for all of your traditional and Roth IRAs is 6000 in 2022 7000 if. For the tax year 2022 which youll file a return for in 2023 that limit stands at 20500 which is up 1000 from the 2021 level.

The numbers are more forward-looking vs. So if you put in todays date 12302021 you might get them purchased tomorrow in 2021. We may have changed your purchase dates to the next available business day.

If your employer offers 401k account and some contribution match make sure you contribute to your 401K account to maximize your employers match first. You can save the lesser of twice the limit41000 in 2022 39000 in 2021or the basic limit per year plus any amount of the basic limit that you didnt use in prior years.

Solo 401k Contribution Limits And Types

The Maximum 401 K Contribution Limit For 2021

Here S How To Calculate Solo 401 K Contribution Limits

The Maximum 401k Contribution Limit Financial Samurai

Solo 401k Contribution Limits And Types

Employer 401 K Maximum Contribution Limit 2021 38 500

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401k Employee Contribution Calculator Soothsawyer

How Much Can I Contribute To My Self Employed 401k Plan

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Solo 401k Contribution Limits And Types

After Tax Contributions 2021 Blakely Walters

401 K Maximum Employee Contribution Limit 2022 20 500

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types

401 K Maximum Employee Contribution Limit 2022 20 500

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer